Mission and Vision

STET is a critical operator for our clients, the banks and the banking communities we serve every day.

Stet is responsible for more than 30 billion transactions a year, representing an average of more than 25 billion Euros per day. This is a great responsibility that we take for banks, central banks and finally end-users.

As a Systemically Important Payment System (SIPS), we commit to respecting the highest level of security, rigour, and transparency.

Doing more for banks today, and even more tomorrow

We assume our role with a full dedication, which embraces day-to-day’s business, and a long-term vision to anticipate tomorrow’s market demand.

As the European payments business is undergoing dramatic changes, benefiting from the industry standardisation and the technology revolution, we work on a continuous process to design new functional and technical solutions, with an architecture capable of responding to tomorrow’s challenges.

Since its creation, STET’s vision is that European harmonisation will not preclude the market diversity. That’s why we develop flexible and sustainable architectures, designed to host the various needs of our clients with user-friendly multi-channel services.

Innovating to anticipate the market needs

What’s happening on the market? What will happen tomorrow and the day after? These questions are our major concern at STET.

In the fast-changing technology landscape, we pay great attention to the market new technical developments and business trends. Being a technology service provider, it means that we help our clients to move into the future and bring them new services to improve their time-to-market.

Enhanced competition involved by the market consolidation makes the importance of being the first on the market a critical point for our clients.

At STET we believe our first mission is to serve our clients todays and to anticipate their tomorrow’s expectations.

We pay great attention to the market evolution, in order to support and accompany our clients’ needs.

Governance

STET brings next generation solutions with open-access and transparent user policies.

Our approach of governance empowers each client’s community to maintain full control over its CSM. As a consequence, STET clearly separates management of a CSM from the corporation running scheme-agnostic processing capabilities. Each has its distinct governance organisation, ensuring balanced priorities:

- The Board is responsible for running the corporation. These responsibilities include overseeing the corporation's strategy, organisation, investments, and future developments,

- For our Clearing services, a governing body is designed for each community. This body has full control over payment instruments and rules for processing or routing them. This governing body's very organisation and governance are decided by each community.

Individual banks are also considered as our flexible clearing services offer allows clients to opt in our additional services, such as Instant Payment.

- For our card services, we designed a flexible network and services able to suit market demands.

A reliable partner of the European payment market

Our disruptive approach of governance that involves all our stakeholders, as well as our open-access policy makes possible for all European banks to benefit from our exceptional track record, our system and network robustness, our 24/7 processing capacity and our cost efficiency.

Thanks to our clients support, we believe we is in a good position to consolidate the European payment market, both on a technical and a business viewpoint.

Having a consistent 360° service offering including a clearing system able to handle the whole range of payment instruments (domestic and SEPA) as well as a routing and authorization network means that we can support all payment issues.

Reachability is also a key issue for STET, that’s why we are working on partnerships to allow our clients to reach any counterpart within the SEPA area.

Finally, we hope the payment market will leverage our price competiveness, which draws on optimized business process and economies of scale generated by our large transaction volumes.

Board Members

STET S.A. is owned by six major banks - BNP Paribas, BPCE, Crédit Agricole, Banque Fédérative du Crédit Mutuel, La Banque Postale and Société Générale – joined by CB Investissements in 2016.

STET’s Board gathers 11 representatives of the Payment Industry:

Click to view more information

Independent Administrator:

Frédéric Burtz

Head of Payments at BPCE Digital & Payments | CEO of BPCE Payment Services

Graduate from Ecole Polytechnique and Ecole Nationale Supérieure des Télécommunications, Fréderic Burtz began his career with France Telecom (1993-1998) and then Capgemini (1999-2011).

From 2011 to 2016, he was involved in the digital transformation of SNCF and contributed to the development of Voyages-sncf.com, France's leading e-commerce site.

In 2016, Frédéric Burtz joined Group BPCE as chief technology & innovation officer. Under his responsibility, BPCE accelerated its digital and technological transformation and supported the digitalisation of its channels.

In 2021, Frédéric will be appointed Group Chief Innovation Officer. He was appointed Chief Executive Officer of BPCE Payment Services in 2023 and is also CTO of BPCE Digital & Payments.

Jean-Paul Albert

Head of Cards at Société Générale Retail France.

Jean-Paul Albert has more than 20 years experience in Cards and Payments.

He joined Société Générale in 1998 where he has held various positions in payments and in marketing.

Jean-Paul Albert began his career as a consultant at Boston Consulting Group and then worked in the credit card business unit of Citibank in Germany and Belgium.

As part of his role Jean-Paul is a board member of Groupement des Cartes Bancaires and of 441 Trust Company Ltd. (UK) and he seats on Visa’s French Client Council. He is also a member of Observatoire de la Sécurité des Moyens de Paiement.

Jean-Paul is a graduate of ESSEC Business school and holds an MBA from INSEAD.

JEAN-DANIEL GRIES

Jean-Daniel Gries is Director of Interbanking Relations and Payment Partnerships at La Banque Postale since 2020.

He started his career at Natixis for the Banques Populaires and worked from 1998 to 2013 for La Poste and La Banque Postale groups in the domain of payments.

From 2013 to 2020, he was President of Transactis, a company in charge of card transaction processing and also active in payment transfers, direct-debits and instant payments for La Banque Postale and Société Générale groups.

He also served as Director and General Director of eZyness from 2017 to 2022.

Jean-Daniel Gries is very much involved in the French card payment ecosystem. He notably represents la Banque Postale at the Vice-Presidency of the CB Board, at the CBI Board and as President of PayCert and FrenchSys, other CBI subsidiaries.

Philippe Laulanie

Chief Executive Officer - CB Card Scheme

Philippe Laulanie is graduate from the EM Lyon Business School and holds an MBA as well as a degree from the IHEDN (Institute of Advanced Studies in National Defence).

Before being appointed to CB as Chief Executive Officer, he has spent most of his career working for BNP Paribas whom he joined in 1989 as Head of Marketing before rapidly moving on to other positions, both in France and abroad.

From General Inspection to Management Control, he has gained extensive knowledge of banking activities.

In 1997, he was entrusted with the task of devising a new distribution model for retail banking, via a multi-channel platform implemented across more than 15 countries.

In 2014, Philippe Laulanie was appointed Chairman of RMW (Retail Mobile Network), a subsidiary of BNP Paribas. This platform, co-designed with major retailers, aims to address the strategic challenges raised by the digitization of business, the simplification of the customer experience and the creation of services.

Philippe Laulanie is also Vice-Chairman of the INRC (National Institute for Customer Relationship) and a member of the Board of EFMA (European Financial Management Association).

Valérie Teissèdre

Deputy Chief Executive Officer of Crédit Agricole Payment Services since October 2016.

In 1986 Valérie Teissèdre began her career as an analyst in Information Systems at EDF. In 1987 she joined Crédit Lyonnais and held various management positions in major projects and extended management within the IT Department, where she was appointed Head of Steering in November 2006, then Director of Development in charge of banking products and services in June 2008. In October 2012 she was appointed Director of Project Management and Processes at LCL, and in May 2014, in addition to, became IT Director. In July 2014, she became a member of LCL's General Management Committee. She joined Crédit Agricole Payment Services in October 2016 as Deputy Chief Executive Officer in charge of operations.

Valérie Teissèdre is a graduate of the Conservatoire National des Arts et Métiers de Paris and holds a - Diplôme d’Enseignement Supérieur Technique in IT specialization.

Michel Vial

Head of Strategy and Development of BNP Paribas Group

Head of Principal Investments

Graduate from Ecole Polytechnique, Michel Vial began his carrer at Arthur Andersen Consulting in 1982. He joined the BNP Group in 1985 where he had worked initially in the Department of Mergers and Acquisitions / Capital Investments, specializing in the technology sector.

In 2008 Michel Vial became the Head of Retail Development, reporting to Jean-Laurent Bonnafé : in charge of BNPP Fortis merger and other projects in retail banking networks and financial services.

Since 2016 Michel Vial is a Board Member of the First Hawaiian Bank (USA), of the First Hawaiian Inc (USA) and of the 441 Trust Company Ltd (UK).

Marc WEISS

Marc Weiss is Head of Crédit Mutuel Payments Department.

His professional career got off to a unique start as a professional handball player during his studies and the following two years.

In 1995, he joined the CIAL organization management team, focusing on international trade and the migration of the hosting platform.

In 2000, he became International Account Manager, specializing in documentary credits.

In 2003, he participated in the centralization of CIAL's foreign services and the merger with SNVB's international department to form CIC Est's international department.

In 2005, he was appointed Technical Manager for Documentary Credits, then National Manager for Documentary Activities.

In 2010, he became Head of the International Business Center (CMI), in charge of the various international transfer, credit and guarantee services.

In 2013, he took over as head of the “Services Bancaires Grands Comptes & Flux Corporate” department.

In 2015, he joined Global Payment Solutions and succeeded Claude Brun in 2017 as Head of the Payments department.

Passionate about sport, particularly handball, he applies the values he acquired in sport to his professional career such as the search of victory for the team thanks to each and everyone own qualities toward collective performance.

Bernard Gouraud

Bernard Gouraud started his career in 1974 at Banque Populaire Bretagne Atlantique as a Project Manager.

He was rapidly promoted within the Banque Populaire group, first as the Head of Innovation & Advanced Technologies, then as the Deputy Director of Research & Development.

After having served as the Director of Marketing & Technologies of 2 subsidiaries of the group, Bernard became successively IT Director in 2002, then Director of Technologies of the group in 2003.

As such, he was responsible for IT projects, information security, business continuity as well as interbank relations and innovation regarding payment instruments.

In 2009, Bernard Gouraud is appointed as the IT & Technologies Director of BPCE (the new banking group resulting from merger of Banque Populaire and Caisse d'Epargne).

Beside these responsibilities, Bernard Gouraud has been a member of the EPC Plenary, and a board member of Allbiant It, Natixis paiement, and CFONB.

With over 30 years' experience in IT optimization, Innovation, and Payment Services, Bernard Gouraud is an Independent Advisor since 2013.

Sophie LAZAREVITCH

Sophie Lazarevitch is Independent Member of the Board of Directors of CA Auto Bank.

She began her career in 1982 as a consultant mainly for the financial sector, a sector which she joined in 1998 as Compliance Officer, CFO, at Euroland Finance. Then, from 2000, she held senior executive positions. From 2000 to 2005, she was CEO, member of the Management Board, in charge of Finance, Compliance, HR, Banking and IT Operations of Vega Finance then of Compagnie 1818. From 2009 to 2011, she became Deputy CEO in charge of Finance, Risks, Operational Efficiency, Legal for the business line in France and Luxembourg of Banque Privée 1818. From 2011 to 2013, she was Head of the Subsidiaries and Investments Department at Natixis, then, until 2017, becomes President of Natixis HCP and Head of the Corporate Data Solutions Division of Natixis, specialized in commercial information, debt collection and factoring. In 2017-2018, she joined the Management Board of Fidor Bank, Groupe BPCE's digital bank, based in Munich, Germany. Finally, she became Advisor to Natixis CFO until the summer of 2019 when she left the group to devote herself to her activities as an independent director.

Sophie Lazarevitch is a graduate of HEC Business School (France).

Patrick RENOUVIN

After graduating from Arts et Métiers (France), Patrick Renouvin began his career in 1980 as an IT engineer at G-CAM (now Inetum).

From 1986 to 1999, Patrick worked as a consultant within the banking and insurance industry ultimately becoming a Senior Manager at Bossard (now Capgemini).

From 1999 to 2012, Patrick leveraged his skills and expertise as Deputy Managing Director at Societe Generale International Retail Banking managing up to 40 subsidiaries. He also managed IT and back offices as Deputy CEO of Credit du Nord. During this period, Patrick held various responsibilities serving as a board member in several of Societe Générale’s subsidiaries abroad.

From 2012 to 2019, he was the Chief Information Officer of La Banque Postale and Réseau La Poste, the chairman of eZyness, an eMoney institution, a board member of Transactis and a member of Digiposte’s strategic committee.

Patrick Renouvin then concluded his career as Chief Operating Officer of Dexia Group in 2024.

Geert Van Antwerpen

Chair of the Board of CEC-UCV Belgium

Policy Advisor Payments at KBC Bank.

Geert Van Antwerpen started his career in 1993 at the Belgian savings bank HSA where he held different staff functions. After the merger to Centea he was appointed in 2001 as the manager of the Foreign Team where he was responsible for international payments, deposits in foreign currencies, Swift and correspondent banking.

As project leader he ensured a successfully migration of the IT-systems towards KBC. He became product manager at KBC in 2007 and cooperated to the launch of SEPA Credit Transfers and to the migration towards the SEPA direct debit. In his role of product manager he represented KBC in different Belgian and European interbank working groups and task forces w.r.t. payments. In 2016 Geert joined the CEC-UCV Board of Directors of which he was appointed as chair in 2021. Currently he works as policy advisor and follows the impact of payment related legislation like PSD2.

Geert Van Antwerpen has been appointed as ‘Censor’ to the Board as from June 2022.

Régis Folbaum

Chief Executive Officer - STET

Régis has been appointed as CEO of STET as of September 2023.

Prior to taking this role, he was the Head of Payments and a member of the Management Committee at La Banque Postale.

From 2012 to 2015, he was the General Manager of MasterCard France. Prior to 2012, he held several positions in the Financial Institutions Group of McKinsey & Co (Paris) and in the Mergers & Acquisitions teams of AGF–Allianz Group (Paris) and at Goldman Sachs (London & New York).

As part of his role, Régis is a member of French Banking Federation Payments Committee and of Banque de France Observatoire de la Sécurité des Moyens de Paiement.

Régis is also a member of the European Central Bank Market Advisory Group on the Digital Euro.

Régis is the former Chairman of FrenchSys and eZyness, a former Vice-President of GIE Carte Bancaire and Visa Europe France, a former Board member of STET and Transactis and a former member of Banque de France Conseil National des Paiements Scripturaux.

Régis Folbaum is a graduate from ESSEC Business School and holds an MBA from INSEAD.

Rodolphe Meyer

Deputy CEO - STET

Graduate of The National School of Electronics, IT and Telecommunications of Bordeaux (ENSEIRB), Rodolphe Meyer began his career at the Caisse de Prévoyance of French Polynesia.

Rodolphe has 30+ years of experience in Payments and is an expert at managing large projects and migrations in complex environments implying multiple international stakeholders.

From 1995 to 2006, he worked at Diamis (now Atos/Worldline) as Product Development Manager and participated, among other projects, in the tender for the development of the CORE system for STET.

In 2006, he put his payments expertise at the service of STET, first as Head of Infrastructure, then as Chief Technical Officer.

In 2016, he was appointed Business Development Director of STET, the newly created entity resulting from the merger of STET with SER2S (Switching subsidiary of Cartes Bancaires).

Since 2020, he was Deputy General Manager of STET.

In 2021, he worked as leader of the Technical Entity Stream for EPI Interim Company to manage the overall architecture of the EPI System for Cards and SCTInst and has served as Senior Advisor for EPI since 2022.

Rodolphe is currently Chief Product Officer in charge of STET’s strategic projects along with Development and Client Relationship teams.

He is also a board member from EACHA.

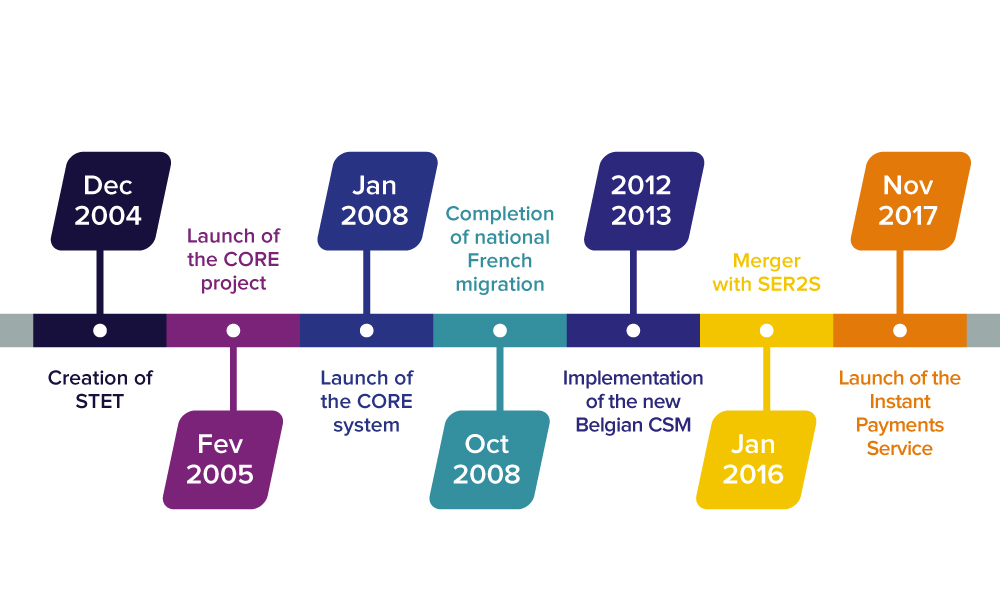

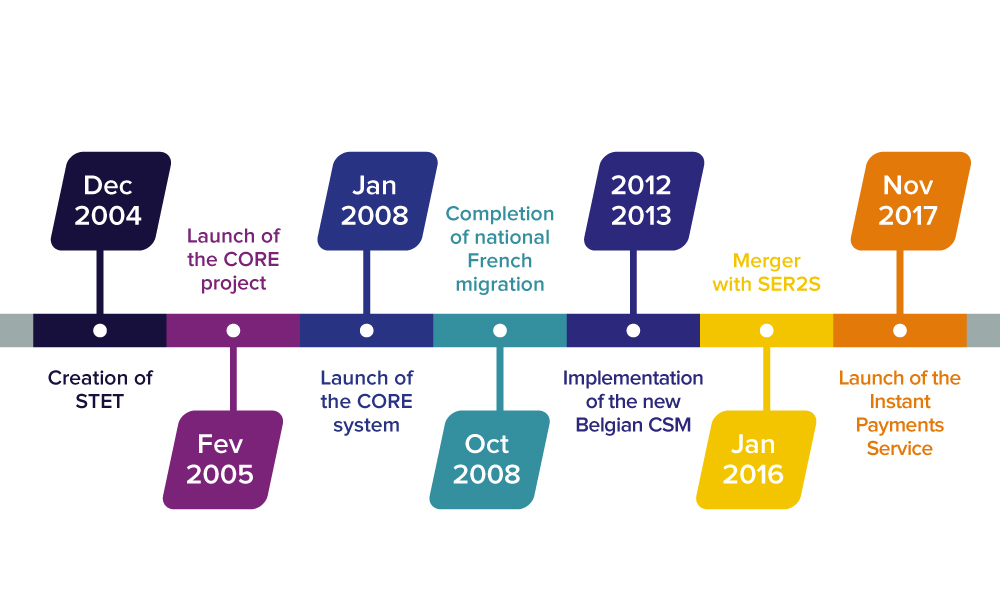

History

Since STET's funding, our vision is that the payments market will retain national differences for a number of years.

The reality of the European clearing market shows that it is multi-currency, multi-payment instruments - SEPA and non-SEPA including Cards - and consumer preference for these varies by community.

That's why we always dedicate to serve the diverse needs of the market.

2004-2015: STET develops and operates the CORE system

In 2004, with the emergence of the SEPA, STET was created by a group of major French banks with a particular goal in mind: to undertake the development of a new platform that would meet the transformation and challenges the payments industry was set to undergo.

Built on years of experience and expertise, the CORE platform was developed with the ambition to create an innovative payment platform for the future European market. This new platform aimed to deliver efficiency and security to a large-volume market, and to provide the requisite architectural flexibility to handle the diversity that would exist for many years.

CORE was successfully launched in January 2008 with the first SEPA SCT payment and, throughout the year, hosted the migration of the full range of payment instruments in the French market.

This was in addition a national consolidation of the clearing by concentrating all payment instruments in a single clearing system.

In 2012, our technical consolidation approach became a reality when the Belgian banking community entrusted STET with the processing, clearing and settlement of SEPA and non-SEPA payment instruments in the Belgian market.

The implementation of the new Belgian CSM ended in March 2013.

2016: STET deepens its expertise in Cards by merging with SER2S

On 18, December, 2015, Stet merged with SER2S, becoming STET SA.

Since January 2016, STET operates the secure E-rsb transport network for cash withdrawal and payment authorisation messages.

With the addition of this network, STET activities now include a strong expertise in cards, as well as the study, design, building and operation of networks and secure interchange and data processing systems, in the context of electronic payment systems.

This operation reinforces STET's strategy to deliver the payment market with state-of-the -art solutions in terms of Real time processing, security, and 24/7 availability.

Key figures

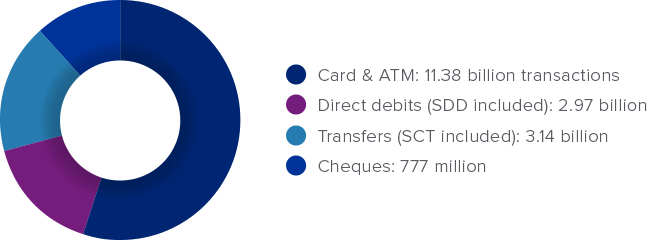

Transaction volumes

In 2022, STET processed 31,07 billion transactions.

18,49

billion transactions

for the French and Belgium Communities

Besides of that, more than

12,58

billion transactions

were routed on our routing & authorisation service

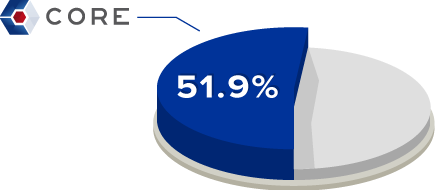

STET's CORE platform is one of the leading ACH in Europe with 51.9% market share of euro transactions multilaterally cleared in Clearing Systems.

The CORE system processes the whole range of payment

instruments on a large scale including all card transactions.

Card & ATM

18.49

billion transactions

11.38 billion

card transactions

routed on our network

In 2022, more than 11,38 billion transactions were routed through

our routing and authorisation service.

Our secure network for cash withdrawal and payment

authorisation messages is in France the reference network

for all card types, including CB, Diners Club International,

JCB, Mastercard, Paylib, Visa.

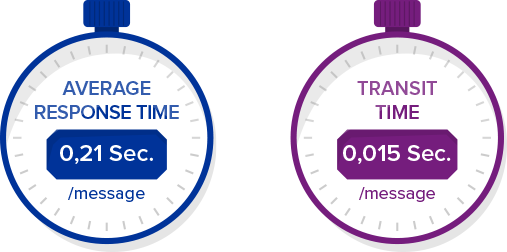

Performance of the CORE system.

Highest peak day

163.40 million transactions

The CORE system processes the whole range of payment

instruments on a large scale including all card transactions.

Performance of our Card routing and autorisation service

Main caracteristics of our card routing and authorisation service

- More than 50% of CB card transactions occurred in France involve an authorisation request and transit via the e-rsb network

- 21.3% of the activity (incoming + outgoing) is international

- Annual infrastructure availability over 99.999%

- Non completed transaction rate due to e-rsb : under 1 in 1 million

Contribution to the industry

As we consider our ongoing dialogue with all the payment industry stake-holders is of great importance, STET is an active contributor to the European discussions and efforts to provide the market with harmonised payment solutions.

European Commitment

STET plays a significant part in the following forums, and task-forces:

EPC

- Card Stakeholders Group Board (CSG),

- Project Management Forum,

- Scheme Technical Forum (ESTF).

ECB

- ACH Task Force on Instant Payments

European Payments Stakeholders Group

- STET is board member of the EPSG and participates in the Acquirer 2 Issuer Task Foprce (A2I TF).

SWIFT

- French Users Board of Directors

- Technical Experts Group

EBA Association

- STET is an asssociate Member and participates in EBA Instant Payments Forum

Berlin Group

- STET has a permanent Representative

Payments System Regulator (PSR) UK

EACHA

As a founding member of the European Automated Clearing House Association (EACHA), STET is actively involved in the:

- EACHA Innovation group

- Technical task Force

- and EACHA Payments Forum.

Local Commitment

CFONB

- Payment instruments Working Groups I & II

- Standards Coordination Working Group

- Certification and electronic signature Working Group

- Regulation & Compliance Working Group

Banque de France

- Crisis Committee

- Stress tests

Fédération Bancaire Française

- Payment Instruments Committee